Despite vowing not to repeat my bad habit of increasing my stop loss and doubling/quadrupling down, I am still doing it. Fortunately while I am on Sim, it is not hurting my live account. But it is having a detrimental effect on my psychology. I did it on two occasions this week and my weekly summary looks horrendous. So unless I can stop this character defect, I am not going to fully commit my real account to the hazard of the market.

I only made one live trade on my real account this week. I waited patiently for price to reverse back into the up trend on oil. Once I had confirmed that price was going up again, I entered one contract, but price reversed exactly at my entry and retraced 22 ticks. My heart rate went up as I sweated profusely hoping that the trade would come back to break even, so I could exit.

After waiting what seem like an eternity, price eventually came back and I exited for a profit of 1 tick to cover my commision and then watched open mouthed as price moved up another 150 ticks without me.

The sad part of this trade was that there was a buy signal just before I exited, but I was blind to it because I had become emotional and was just hoping for a break even trade. So despite having correctly analysing the direction of price, I am still not making any money.

This is really getting to me and I am losing confidence in my ability to make a living from trading.

I will continue sim trading until I can cut out the bad habits and from next week, I will not move my stop loss or double down. If I can do this for 2 weeks, then I will start commiting my real account to the market.

I will post my live trade on my next post to show what I look for when taking the trade.

So after starting the week quite well, I succumbed to my weakness. I will learn from these mistakes and improve as a trader and as a person.

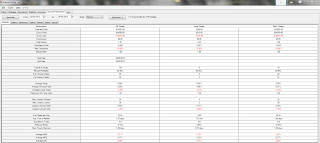

I am attaching this weeks summary to remind me of the horrors of surrendering to my bad habits.

No comments:

Post a Comment